CrowdStrike's IPO (initial public offering) delivered strong results for the endpoint protection company. Shares in the MSSP-friendly cybersecurity company (symbol: CRWD) skyrocketed roughly 87 percent during its first day of trading, and CrowdStrike raised roughly $612 million in the process.

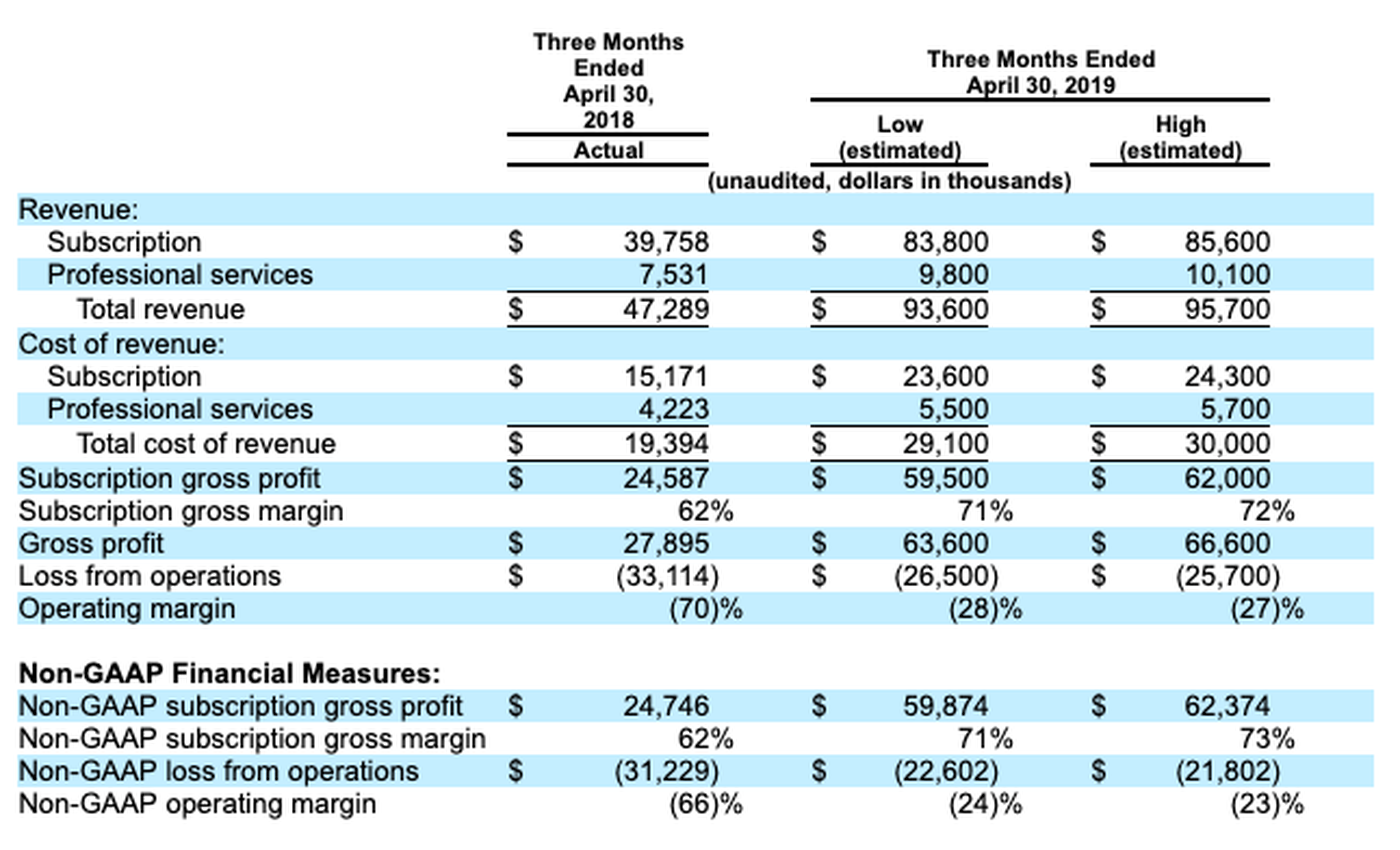

The endpoint security software company's latest financial picture, according to an updated SEC filing, looks like this:

Financial metrics from an earlier SEC filing reveal these indicators:

- Revenue of $249.8 million for fiscal 2019, up from $118.8 million in fiscal 2018 and $52.7 million in 2017.

- Annual recurring revenue of $312.7 million as of January 2019, up from $141.3 million as of January 2018 and $58.8 million as of January 2017.

- Net loss of $140 million for fiscal 2019, up from a $135.5 million net loss in fiscal 2018, and a $91.3 million net loss in fiscal 2017.

CrowdStrike MSSP Partner Strategy

Twitter: @CrowdStrike

Twitter: @CrowdStrikeAn earlier SEC filing also described CrowdStrike's channel partner strategy, MSSP partner model, and expansion from large enterprises into small businesses. The filing stated:

"We do not consider our channel partners as customers, and we treat managed service security providers, who may purchase our products on behalf of multiple companies, as a single customer. While initially we focused our sales and marketing efforts on large enterprises, in recent years we have also increased our sales and marketing to small and medium sized businesses. We estimate that, as of January 31, 2019, approximately two-thirds of our subscription customers were organizations with fewer than 1,000 employees."

The company's managed security services strategy leans heavily on Falcon Complete -- a cloud module designed to address the managed security services market. Describing the development, CrowdStrike stated in an earlier filing:

"While our initial goal was to target smaller organizations that lacked security staff resources, this solution has also benefitted larger enterprises with thinly-staffed security teams...We estimate that our directly addressable opportunity in this segment is approximately $4.4 billion in 2019 and will reach $5.1 billion in 2021."

The company sees growth opportunities across five focus areas — including:

- Corporate Endpoint Security

- Threat Intelligence

- Security and Vulnerability Management

- IT Service Management Software

- Managed Security Services

Endpoint Security Market: Crowded, Growing, Evolving

CrowdStrike's imminent IPO comes at a key time for the cybersecurity market. Among the key wildcards: At what point will cyber startups shift from fast-growth mode to focus more heavily on profit growth? Assuming CrowdStroke makes it to public markets, the company could be a bellwether stock for that growth-vs-profit debate.

Fast-growth startups such as AlienVault and Cylance both got acquired ahead of potential IPO pursuits. AT&T and BlackBerry, respectively, snapped up those companies in 2018. Folks are also watching Carbon Black and Cybereason for ongoing clues about the cyber market's overall health.

The CrowdStrike IPO and long-term company performance could also provide new clues about the health, opportunities and challenges facing entrenched rivals such as Symantec and McAfee. In recent months, multiple Symantec executives have resigned amid the company's effort to reinvent itself for modern cloud and mobile needs.

Story originally published May 30. Updated June 11 with new financial information from SEC filing.